CASE STUDY

AI-driven trading platform for a FinTech giant

How Syberry helped a $1.5B FinTech leader transform trading with AI and automation.

Tech stack/tools we used: Java, Python, JavaScript, Spring, Jooq, Flyway, Tornado, SQLAlchemy, Pandas, PostgreSQL, AWS, Splunk Cloud, Datadog, OpenAI, Typescript, React, Redux, RxJS, OpenFin, Jira

- +22%

stock price increase

- $10T

securities traded daily

- $1.5B

in yearly revenue

- S&P 500 Index

featured in

Client

Global FinTech company is developing a new product

Our client is an international leader in financial technology that offers critical solutions to support investing, corporate governance, and financial communications. They serve a wide range of clients with advanced platforms for regulatory compliance, trade lifecycle automation, and wealth management.

Solution

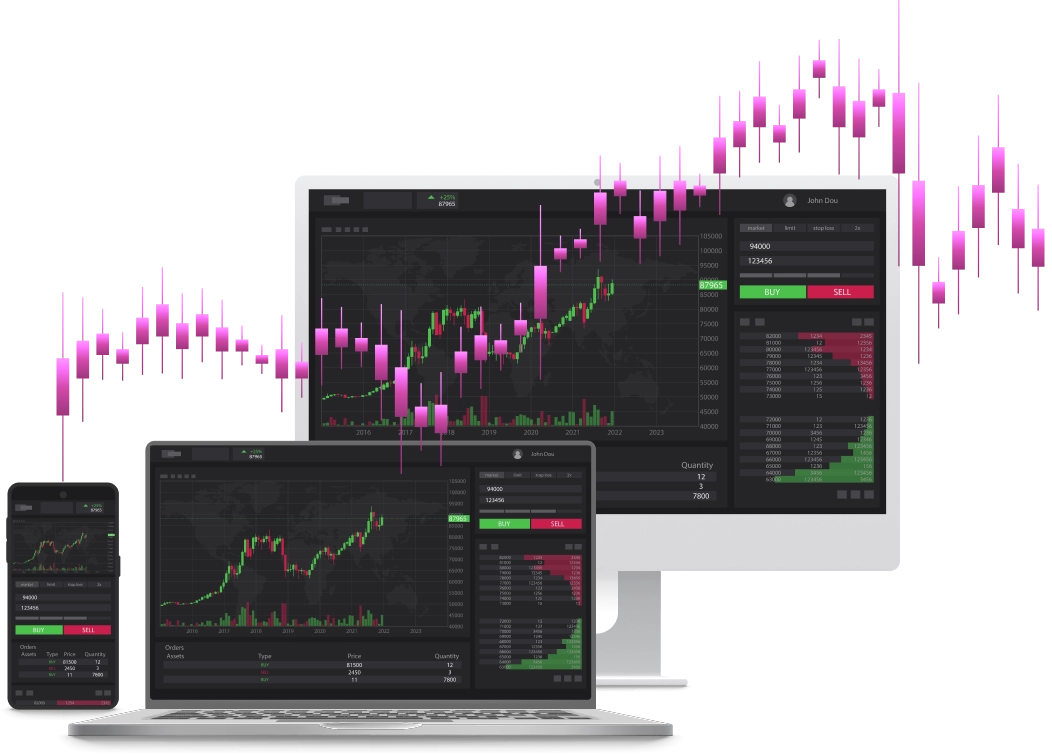

Next-generation B2B trading platform

Syberry is developing an AI-driven trading platform that centralizes and streamlines the client’s trading operations.

The platform pulls real-time market data, generates analytics, and provides users with actionable insights. Built-in auction functionality helps users buy and sell assets efficiently, and risk management tools assess exposures and suggest mitigation strategies.

The platform automates key workflows by taking over tasks like order execution, payment processing, and compliance tracking. It unifies client communication through an omni-channel module to allow users to interact across multiple channels from a single interface.

Through integrating data, automation, and decision-making tools, the solution lets users execute trades, manage risks, and maintain client interactions with speed and precision.

Succeed faster with Syberry

We aim to deliver an MVP between 6-12 months

Key features

AI-powered trading assistant

The platform features an AI-powered chatbot connected to internal databases and the web, ensuring precise, reliable answers to trade-related questions. Users can access market insights, operational details, and execute trades directly through the chat.

This chatbot goes beyond basic queries, generating charts, building tables, and streamlining asset management—all within the chat interface. It simplifies workflows and empowers users to make informed decisions instantly.

Real-time investment dashboard

The platform constantly scans global markets and provides real-time updates on market trends, asset performance, and emerging opportunities. Users receive instant notifications about critical shifts, helping them react quickly and capitalize on favorable conditions.

With dynamic dashboards and tailored alerts, users can track key metrics, identify risks, and stay ahead of market changes.

Integrated auction system

The platform features an auction mechanism that allows users to buy and sell assets in real-time. For both stocks, bonds, and alternative investments, users can participate in competitive bidding directly from the platform.

With transparent pricing, instant transaction updates, and secure processing, the auction system automates trading workflows. Users can execute trades efficiently while minimizing risks and maximizing returns, all within a single, unified environment.

YOU MIGHT ALSO BE INTERESTED IN...

Finance

Game-changing financial platform

This data-driven investment management firm built a product to change the game in the industry. A group of quantitative analysts from one of the major financial centers founded a broker company with a clear focus on business automation and cutting-edge technological solutions.

Technology

Sales management software for a mobile device reseller

Custom software let this client adapt to the changing market conditions and focus on business growth.

Finance

Big data processing platform

Explore our client's journey from a startup to a big data powerhouse with $150M+ investments raised.

Finance, Startups

Payment processing system for a B2B FinTech startup

This entrepreneur created a disruptive payment platform for small businesses. Our client, a dynamic B2B FinTech startup, is committed to empowering small businesses with streamlined payment solutions. They aim to revolutionize traditional payment systems by offering an all-in-one invoicing and bill pay platform that eliminates fees and simplifies transactions for businesses in the United States.

Succeed faster with Syberry

We aim to deliver an MVP between 6-12 months