CASE STUDY

Payment processing system for a B2B FinTech startup

This entrepreneur created a disruptive payment platform for small businesses.

Tech stack/tools we used: React, Java Spring Boot, Docker, Azure

Client

B2B Fintech platform

Our client, a dynamic B2B FinTech startup, is committed to empowering small businesses with streamlined payment solutions. They aim to revolutionize traditional payment systems by offering an all-in-one invoicing and bill pay platform that eliminates fees and simplifies transactions for businesses in the United States.

Problem

Securing investments for a yet another FinTech startup

The client faced challenges in securing funding and assembling a dedicated team to bring their vision to life. Additionally, they needed a robust proof of concept to attract investors and establish credibility in the competitive FinTech landscape.

Solution

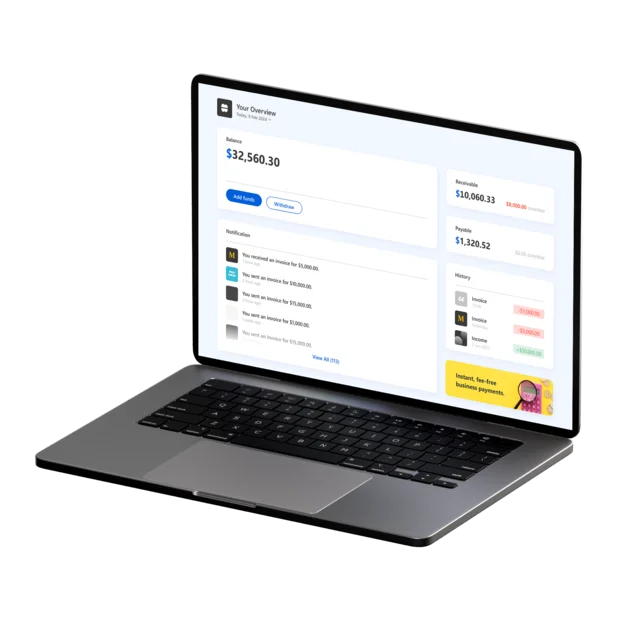

All-in-one payment platform

In the initial phase, we focused on developing core platform features that didn't rely on immediate bank integration, enabling the client to advance their project while they sought a compatible banking partner.

Following the integration with a banking partner, we transitioned to phase two. Despite tight timelines, we swiftly scaled up our team and accelerated development, incorporating new features to meet evolving requirements.

Result

Growing startup that transforms transaction efficiency

- $9.7M

investments raised

- 1000+

banks synced via Plaid

- 2000+

B2B users

Challenge #1

Bank partner integration

Integrating with banking partners posed significant technical challenges, including navigating complex APIs, ensuring data encryption and privacy compliance, and synchronizing transactional data seamlessly across platforms. Addressing these hurdles required close collaboration between our development team and the bank's IT specialists, extensive testing, and iterative refinement of our approach to ensure smooth interaction and compatibility.

Challenge #2

Technical complexity

The platform's complex architecture, featuring multiple interconnected components such as payment gateways, invoicing systems, and user authentication modules, added layers of technical complexity. To overcome this challenge, we meticulously designed and implemented the solution, prioritizing modularity, scalability, and fault tolerance to handle future growth and changing user needs.

Challenge #3

Short development timeline

To meet this challenge, we implemented agile project management practices, swiftly allocated resources, and coordinated closely among cross-functional teams. We prioritized critical features and established efficient communication channels to ensure alignment and prompt decision-making. This approach enabled us to meet tight deadlines without compromising product quality.

Succeed faster with Syberry

We aim to deliver an MVP between 6-12 months

Key features

Ability to complete transactions

We engineered core transactional features, including invoice generation, payment processing, and receipt tracking, to showcase the platform's operational capabilities to potential investors.

Scalable architecture

We architected a scalable and resilient system capable of integrating smoothly with banking partners' APIs for secure and efficient financial transactions. The architecture was designed with future growth in mind, allowing for easy expansion and adaptation to evolving business needs.

Intuitive UI/UX

We partnered with the in-house team to craft a user-friendly front-end interface, prioritizing simplicity and clarity in design. This approach involved implementing intuitive navigation, clear call-to-action elements, and responsive design principles for seamless usability across devices.

YOU MIGHT ALSO BE INTERESTED IN...

Finance

Game-changing financial platform

This data-driven investment management firm built a product to change the game in the industry. A group of quantitative analysts from one of the major financial centers founded a broker company with a clear focus on business automation and cutting-edge technological solutions.

Technology

Sales management software for a mobile device reseller

Custom software let this client adapt to the changing market conditions and focus on business growth.

Finance

Big data processing platform

Explore our client's journey from a startup to a big data powerhouse with $150M+ investments raised.

Finance

AI-driven trading platform for a FinTech giant

Discover how we helped this business speed up and improve their custom software.

Succeed faster with Syberry

We aim to deliver an MVP between 6-12 months